PM Laptop Loan Scheme 2026 is a flagship initiative by the Government of Pakistan aimed at providing students, freelancers, and young entrepreneurs with laptops on easy, interest-free monthly installments. The scheme offers three laptop categories with financing up to PKR 450,000, helping youth overcome financial barriers to education, freelancing, and online business.

Eligible Pakistani citizens can apply through the official portal by submitting personal, educational, and financial details. With a clear step-by-step application process, strict eligibility criteria, and transparent verification, this program supports digital skills, remote work opportunities, and a stronger digital future for Pakistan’s youth.

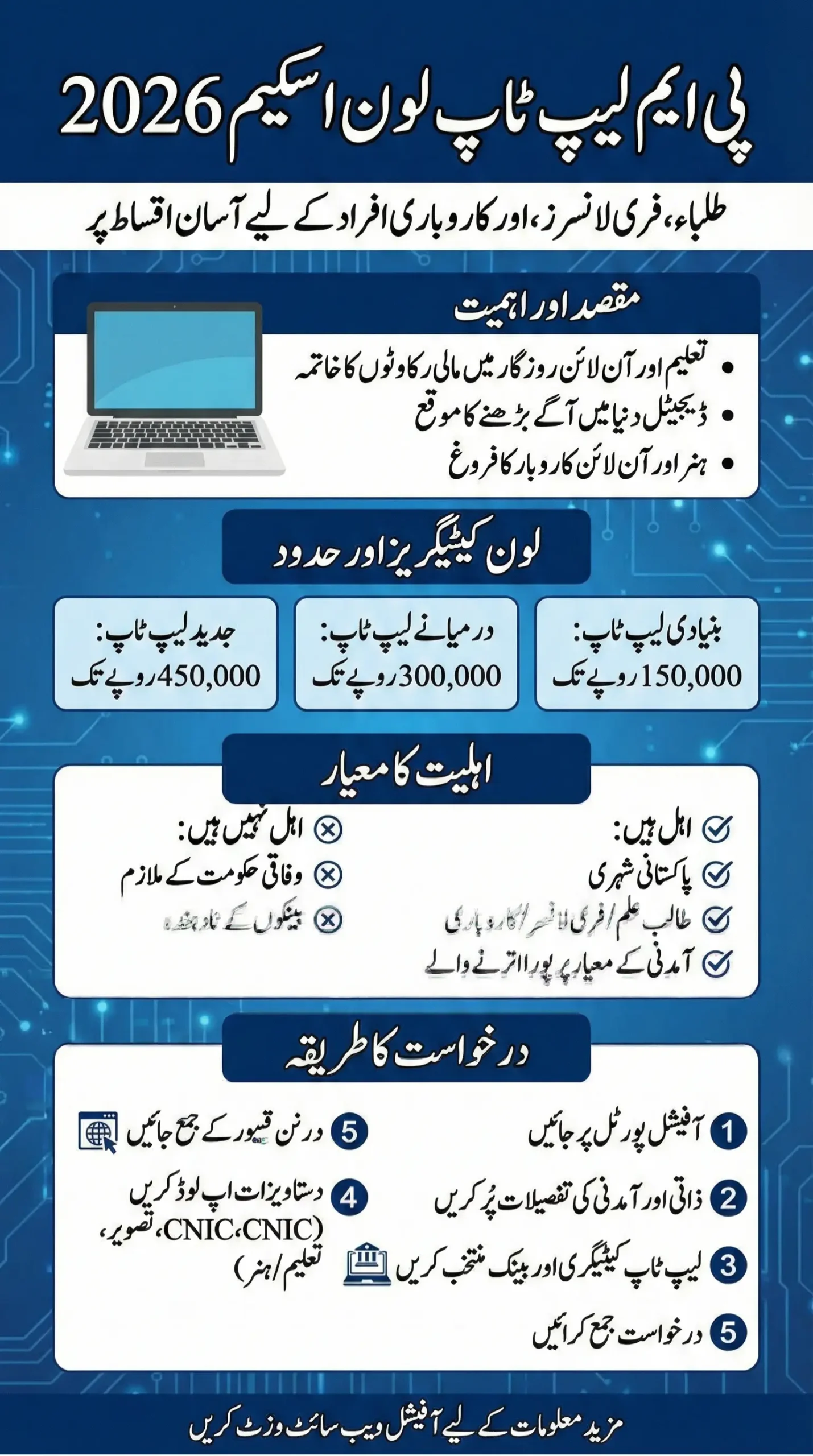

PM Laptop Loan Scheme 2026

PM Laptop Loan Scheme 2026 is a major initiative of the Government of Pakistan to provide quality laptops to students, freelancers and new entrepreneurs on easy monthly installments. The scheme aims to remove financial barriers to youth to move forward in the digital world, pursue education and access online employment opportunities.

This scheme will not only promote education and skills but also provide youth with an opportunity to establish their foothold in online business and the global market. If you meet the criteria, you can apply on time and be a part of this digital revolution, which lays the foundation for a strong and self-sufficient future for Pakistan.

Why This Scheme Matters in 2026

In today’s fast-paced digital world, a reliable laptop is not just a tool, it is an essential gateway to learning, income generation, and global opportunities. However, many skilled youth in Pakistan cannot afford high-quality laptops because of their high prices. This means you can:

- Start an online business or freelancing career.

- Continue higher education without technological limitations.

- Learn new digital skills and access global job markets.

By giving affordable access to laptops, the government is investing directly in the country’s digital workforce.

Also Read: Rescue 1122 Internship 2026 Online Apply Via CTS Portal – Know Full Guide

Loan Categories & Financing Limits

The scheme offers three categories of laptops, each with a different financing limit so applicants can choose based on their needs and budget:

| Laptop Category | Maximum Loan Amount (PKR) |

| Basic Laptop | Up to 150,000 |

| Medium Laptop | Up to 300,000 |

| Advanced Laptop | Up to 450,000 |

Choosing the right category is important. A basic laptop might be perfect for education and light work, while advanced laptops are ideal for graphic design, software development, and heavy-duty digital work.

Eligibility Requirements

Not everyone can apply for this scheme, so it is important to know the requirements before starting your application.

You are eligible if:

- You are a Pakistani citizen.

- You are a student, freelancer, or entrepreneur with a valid reason for needing a laptop.

- You meet the income criteria set by the scheme.

You cannot apply if:

- You are a serving employee of the federal government.

- You have outstanding unpaid loans from banks or financial institutions.

Also Read: Punjab Rashan Card Program Online Application and Registration – Complete Guide 2026

Required Documents for Registration In PM Loan Program

Before you start the registration process, gather all the necessary documents to avoid delays or mistakes:

- CNIC number and issue date.

- Recent passport-size photograph.

- Scanned copies of CNIC (front and back).

- Date of birth as per CNIC.

- Educational details (degree, transcript, university name).

- Proof of skills if applying as a skilled professional.

- Business details for entrepreneurs/freelancers (if applicable).

- Contact numbers (primary and secondary).

- Monthly income and household expenses information.

Also Read: PSER Survey Registration Start Again Through Official Web Portal for Rashan Card

Step-by-Step Registration for PM Laptop Loan Scheme

Here is how you can apply for the PM Laptop Loan Scheme 2026 easily and safely:

Step 1: Access the Official Portal

Visit the official government website for the scheme. Always ensure you are on the authentic portal to avoid scams.

Step 2: Fill in Personal Information

- Enter your CNIC number and issue date.

- Select your laptop category (Basic, Medium, Advanced).

- Choose your preferred bank for loan processing.

- Upload your photograph and CNIC scans.

- Provide your date of birth, gender, and family details.

Step 3: Add Address Details

- Enter your present address and select your province, district, and tehsil.

- If your permanent address is different, enter it separately.

Step 4: Provide Contact and Financial Details

- Enter your mobile numbers.

- Add your monthly income (or guardian’s income if you are a student).

- Mention your monthly household expenses.

Step 5: Educational or Business Information

- Students: Provide university name, degree, and upload your transcript.

- Freelancers/Entrepreneurs: Provide business type, skills, and portfolio links (Fiverr, Upwork, LinkedIn).

Step 6: Select Loan Amount

Choose the amount based on your laptop category and financial capacity.

Step 7: Declare Existing Loans

If you already have a loan, provide details like bank name, approved limit, outstanding balance, and monthly installment.

Step 8: Submit Application

Check all details carefully, agree to the terms, and submit your application. You’ll receive an acknowledgment with a reference number.

Also Read: PSER Login – Complete Guide to Access Punjab Socio Economy Registration Portal

After Submission – What Happens Next

Once you submit your form:

- Your documents will be verified by the loan processing team.

- You may be asked for additional information or in-person verification.

- If approved, the loan will be transferred to your selected bank.

- You will receive your laptop and repayment schedule.

Tips to Increase Approval Chances

To improve your chances of getting approved:

- Double-check your application before submitting.

- Ensure all uploaded documents are clear and readable.

- Provide truthful and complete information.

- Avoid applying if you have unpaid loans.

- Keep your phone number active for verification calls.

Also Read: UBL Reveals Brand New Toyota Yaris on Easy Monthly Installments 2026

Conclusion

The PM Laptop Loan Scheme 2026 is more than just a financing program it is a gateway to new opportunities. By giving young Pakistanis access to affordable laptops, the government is opening doors to education, skill development, and online income generation.

If you meet the eligibility criteria, prepare your documents today and apply. This is your chance to take a major step towards building a better digital future for yourself and the country.

FAQs

Who is eligible for the PM Laptop Loan Scheme 2026?

Pakistani citizens who are students, freelancers, or entrepreneurs, and meet income requirements.

Is the loan interest-free?

Yes, it is completely interest-free.

Can I choose any laptop model?

You can select from predefined categories (Basic, Medium, Advanced).

How long does approval take?

Usually a few weeks, depending on document verification.

What happens if I miss an installment?

Contact your bank immediately to arrange a new payment plan.