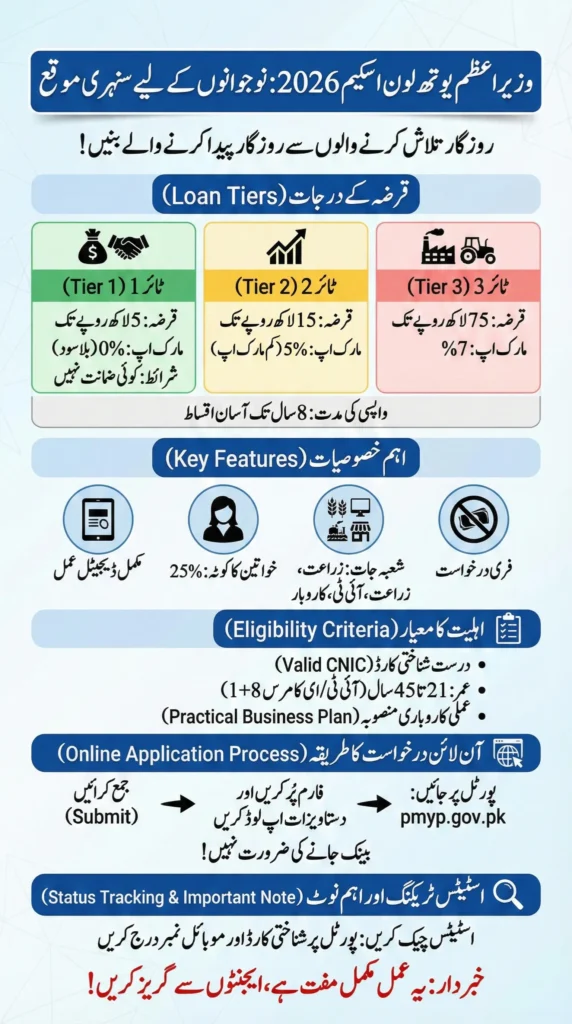

The PM Youth Loan Scheme 2026 offers young Pakistanis a powerful opportunity to start or expand a business through interest-free and low-markup loans up to Rs. 7.5 million. Managed through the official pmyp.gov.pk portal, the scheme allows online application and CNIC-based status tracking without visiting banks.

With three loan tiers, flexible repayment up to eight years, and clean loans for small startups, it supports businesses, agriculture, and IT ventures. Reserved quotas for women and a transparent digital process make this scheme a practical path from job seeking to job creation in 2026.

PM Youth Loan Scheme 2026 Is a Big Deal

Youth unemployment remains a serious issue, but this scheme flips the script. Instead of chasing jobs, young people are being encouraged to create jobs.

Under the supervision of the Government of Pakistan, the Prime Minister’s Youth Business & Agriculture Loan Scheme (PMYB&ALS) focuses on access, affordability, and transparency.

No bank hopping.

No long files.

One digital portal.

Also Read: 9999 Ramzan Relief Package 2026: Rashan Details And Complete Guide

PM Youth Loan Scheme 2026 Key Details

| Feature | Details |

|---|---|

| Scheme Name | PM Youth Business & Agriculture Loan |

| Maximum Loan | Up to Rs. 7.5 Million |

| Interest (Tier 1) | 0% (Interest-Free) |

| Official Portal | pmyp.gov.pk |

| Age Limit | 21–45 years (18 for IT/E-commerce) |

| Repayment Period | Up to 8 years |

| Partner Banks | NBP, BOP, HBL, Meezan & others |

| Status Check | Online via CNIC |

What Makes This Scheme Different in 2026?

Unlike older loan programs, this one is fully digitized. From application to tracking, everything runs through one portal. Even better, 25% of the loans are reserved for women, making it one of the most inclusive financing initiatives in Pakistan.

The scheme is divided into three loan tiers, so whether you’re starting small or thinking big, there’s room for you.

Read More: PSER Online Registration 2026: Full Guide for Ramzan Relief Package

Eligibility Requirements

You do not need a fancy degree or years of experience. What you need is a clear idea and eligibility.

You qualify if:

- You’re a Pakistani citizen with a valid CNIC

- Your age is between 21–45 years

- IT/E-commerce applicants can apply from 18 years

- You have a practical business or agriculture plan

- Your project is commercial (not personal use)

Loan Tiers & Markup Rates – 2026 Update

Here’s where most people get confused. Let’s keep it simple:

Tier 1 – Startup Friendly

- Rs. 100,000 to 500,000

- 0% markup (interest-free)

- No collateral required

- Best for first-time entrepreneurs

Tier 2 – Small Business Growth

- Rs. 500,000 to 1.5 million

- 5% markup

- Clean loan (personal guarantee only)

Tier 3 – SME & Agriculture Projects

- Rs. 1.5 million to 7.5 million

- 7% markup

- For large businesses and farming projects

Read More: Pakistan Approves Hajj Policy 2026 – Confirms Quota & Road to Makkah Expansion

Documents Required

Having documents ready saves time and avoids rejection.

Keep digital copies of:

- CNIC (front & back)

- Recent passport-size photo

- Highest education certificate

- Experience certificate (optional but helpful)

How to Apply Online in 2026

Applying is easier than opening a bank account.

Follow these steps:

- Visit pmyp.gov.pk

- Click “Apply for Loan”

- Enter CNIC and issue date (NADRA verification)

- Select your preferred bank

- Fill in personal and business details

- Upload documents

- Review and submit

You will receive a tracking number via SMS do not delete it.

Also Read: BISP Registration Check by CNIC 2026 – Complete 8171 Verification & Eligibility Guide

How to Check Application Status via CNIC

No need to visit banks or make calls.

Check status online:

- Open pmyp.gov.pk

- Click “Track Application”

- Enter CNIC and registered mobile number

Your status will show as:

- Submitted

- In Process

- Approved

- Rejected

Why Applications Get Delayed

From user feedback, delays usually happen due to:

- Weak or unrealistic business plans

- Incomplete documents

- Selecting the wrong loan tier

- Not responding to bank verification calls

A clear, honest business plan speeds things up more than anything else.

Also Read: 9999 CNIC Check for Ramzan Relief Package Via SMS – Step-by-Step Guide

Helpline & Official Support

If your application seems stuck, use official channels only.

- 📞 PMYP Helpline: 051-9203586

- 📧 Email: helpdesk@pmyp.gov.pk

- NBP: 021-111-627-627

- BOP: 042-111-267-200

Avoid agents — this scheme is completely free.

Final Words

The PM Youth Loan Scheme 2026 is not just another government announcement. It is a real chance to turn ideas into income. With interest-free loans, CNIC-based tracking, and online processing, this program removes excuses and opens doors.

If you’re serious about starting or expanding a business, apply early, choose the right tier, and keep checking your status online. For many young Pakistanis, this loan could be the difference between waiting for opportunities and creating one.