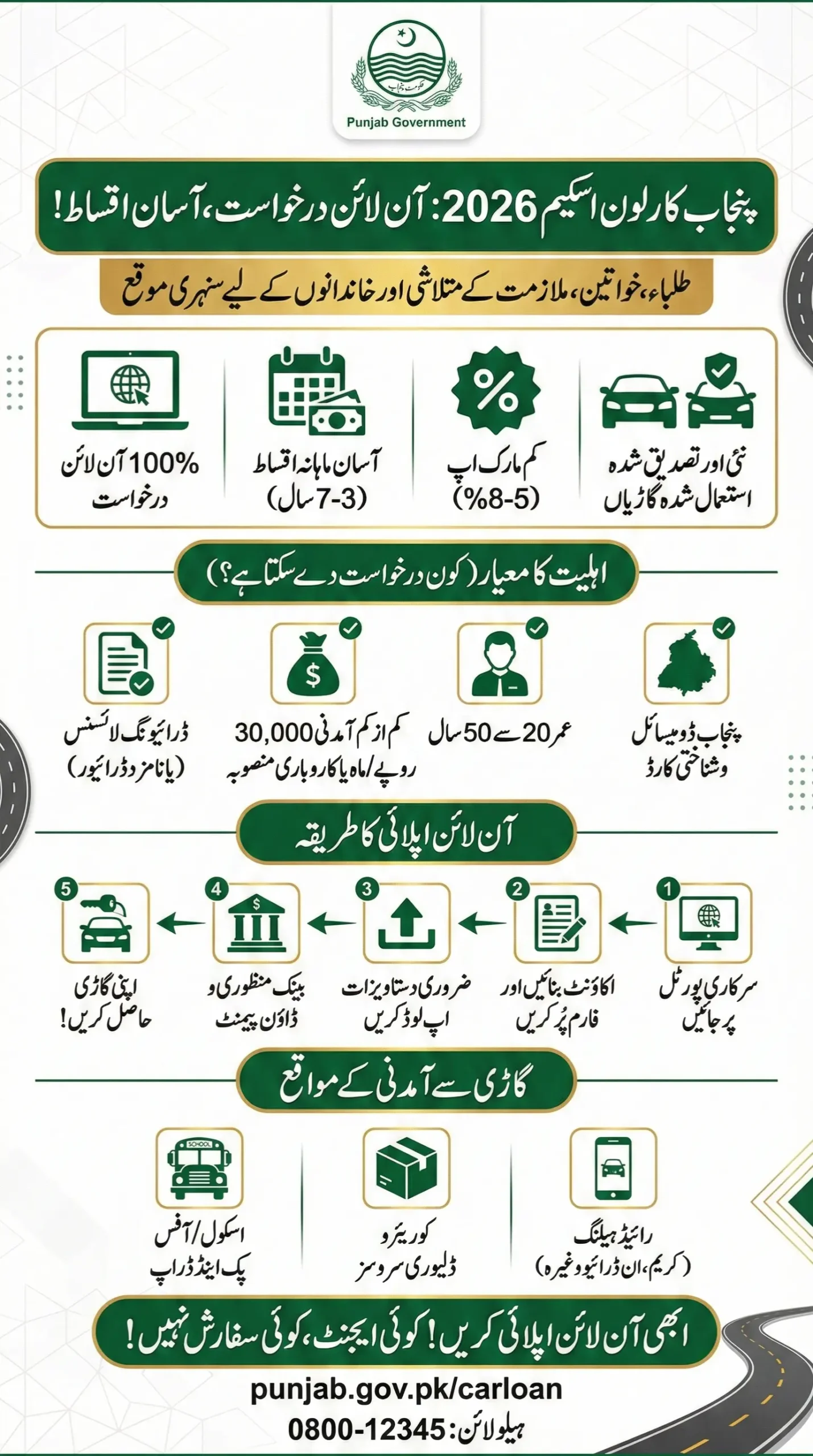

The Punjab Car Loan Scheme 2026 offers an easy and affordable way to own a car through online application, low markup, and flexible installments. Open to students, women, job seekers, and low-to-middle-income families, the scheme allows financing for new and certified used vehicles with repayment options from 3 to 7 years.

Applicants need a valid CNIC, Punjab domicile, and minimum Rs 30,000 income or a simple earning plan. With digital processing, reserved quotas, and income-generation potential, the scheme improves mobility, supports self-employment, and removes the need for agents or middlemen.

Why This Scheme Is Getting Attention in 2026

This isn’t a typical bank auto loan. The government-backed structure removes unnecessary hurdles and gives applicants flexibility especially those who are self-employed or just starting their careers.

People using bikes for long commutes, ride-hailing drivers renting cars, and families dependent on public transport now have a realistic alternative.

Also Read: PSER Registration Process for Punjab Citizens – Step-by-Step Guide 2026

Punjab Car Loan Scheme Key Details

| Feature | Details |

|---|---|

| Scheme Name | Punjab Car Loan Scheme 2026 |

| Vehicle Type | New & Certified Used (up to 3 years old) |

| Loan Tenure | 3 to 7 years |

| Markup | Approx. 5–8% |

| Minimum Income | Rs 30,000/month |

| Target Groups | Students, women, job seekers |

| Application Mode | 100% Online |

| Processing | Bank + digital verification |

Who Can Apply for Punjab Car Loan Scheme?

The eligibility rules are clear but flexible enough to include non-salaried applicants.

Basic Eligibility

- Punjab domicile with valid CNIC

- Age between 20 to 50 years

- Monthly income Rs 30,000 or above

- No previous loan default

- Driving license (or nominated driver for women/differently-abled)

Job seekers and freelancers can apply with a simple earning plan like ride-hailing or delivery work. This often improves approval chances.

Read More: Apna Khet Apna Rozgar Program Launched in Punjab – Know Full Details 2026

Documents Requirements

Most delays happen due to incomplete paperwork. Make sure your documents are clear and updated.

- CNIC (front & back)

- Passport-size photograph

- Salary slip or bank statement

- Utility bill (address proof)

- Driving license (or nominee’s)

- Bank account details for EMI

- Proof for women/differently-abled quota (if applicable)

How to Apply Online – Step-by-Step

The entire process is digital. No agents, no sifarish.

- Visit the official Punjab government vehicle financing portal

- Create an account using CNIC & registered mobile number

- Fill in personal, income, job, and nominee details

- Choose a new or certified used vehicle

- Upload documents

- Submit the form and save your tracking ID

- Wait for bank verification & approval call

- Pay down payment and sign financing documents

- Collect your car from an authorized dealer

That’s it.

Also Read: 8070 Ramzan Relief Package 2026 – Rs. 10,000 Aid, Registration & Latest Updates

Punjab Car Loan Scheme Installment Plan

Actual EMIs depend on vehicle price, tenure, and insurance, but here’s a general idea:

| Car Price | Down Payment | Tenure | Monthly EMI (Approx) |

|---|---|---|---|

| Rs 1.6M | 15% | 5 years | Rs 25k – 28k |

| Rs 2.0M | 20% | 6 years | Rs 26k – 30k |

| Rs 2.4M | 20% | 7 years | Rs 30k – 35k |

Experts recommend keeping EMI under 35% of monthly income.

Key Benefits of Punjab Car Loan Scheme

- Lower markup than market auto loans

- Flexible repayment (3–7 years)

- New & used vehicle options

- Special support for women & differently-abled

- Fast digital processing

- No middlemen involved

Also Read: 9999 Online Check CNIC 5000 – Instantly Verify Aid Status in Pakistan

Income Opportunities After Getting the Car

This is where the scheme becomes powerful. Many applicants plan to earn directly from the vehicle, such as:

- Ride-hailing (Careem, InDrive, Yango)

- Courier & grocery delivery

- School/office pick-and-drop

- Airport & weekend transport services

A clear earning plan does not just help repayments it also boosts approval chances.

Check Punjab Car Loan Scheme Status Online

Once applied, you are not left guessing. You can track progress via:

- Online portal using CNIC & tracking ID

- SMS alerts on registered number

- Authorized dealership (after approval)

- Punjab e-Khidmat Centers for assistance

Also Read: CM High Tech Mechanization Financing Program – Interest-Free Loans For Punjab Farmers 2026

Safety & Legal Advice

- Apply only through official portals

- Never pay anyone for “guaranteed approval”

- Activate insurance/takaful immediately

- Follow transport rules if using car commercially

Final Thoughts

The Punjab Car Loan Scheme 2026 is not just about owning a car it is about mobility, income, and independence. With low markup, flexible installments, and inclusive eligibility, it opens doors for people who were previously locked out of vehicle ownership.

If used wisely, this scheme can turn a car into an asset, not a burden. For families, students, and job seekers across Punjab, this might be the smoothest road forward yet.